One-off short-term transfers hide shift towards greater poverty levels as almost 630,000 people live in poverty

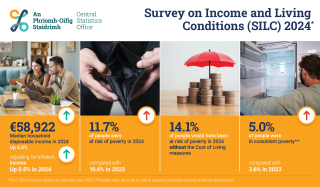

One-off short-term transfers and cost of living measures repeated over successive budgets are masking the shift towards greater levels of poverty. Today’s Survey on Income and Living Conditions figures from the Central Statistics Office show that over one in ten people were living in poverty in 2024. Without short-term cost of living measures this would have been one in seven people. Even with additional short-term measures, poverty increased between 2023 and 2024, a worrying trend.

Key findings

- 629,495 people in Ireland are living in poverty (11.7 per cent), of which 190,108 are children.

- Without temporary cost of living measures, 14.1 per cent of the population (an additional 129,000 people) would have been living in poverty.

- 106,385 older people are living in poverty, an increase of 64 per cent compared to 2023. This number would be substantially higher were it not for the impact of one-off measures.

- 140,377 people living in poverty are in employment - the “working poor”.

- 269,015 people in Ireland are in consistent poverty, an increase from 3.6 per cent in 2023 to 5 per cent in 2024.

- Seven in ten persons experiencing consistent poverty are living in rented or rent-free accommodation.

- Almost one in three people who are unable to work due to long-standing health problems are living in poverty.

- One in three persons who are unemployed are living in poverty. In addition, there was a spike in consistent poverty among the unemployed, doubling from 9.4 per cent in 2023 to 18.9 per cent in 2024.

Short-term transfers have been hiding a shift towards greater poverty levels overall, a trend observed in 2023 and again in 2024. A clear example of this is the poverty rate among older people, which increased by 64 per cent in a year with more than 106,000 older persons living in poverty in 2024 compared to almost 65,000 in 2023. Furthermore, this number would have risen even further without temporary cost of living supports, and more than one in five older people would have been in poverty. This trend of temporary supports hiding rising poverty rates is very concerning and poses a major challenge to Government as these measures will end in April.

Today’s figures point to the long term economic and social impact of rising prices on households on the lowest incomes as these temporary measures wind down. The deprivation rate for households experiencing poverty has increased substantially in the past year, from just over 33 per cent in 2023 to over 43 per cent in 2024. Continued inflation means that the real value of household income is being eroded, placing households reliant on fixed incomes in a very precarious position

As we have consistently pointed out, temporary measures in recent Budgets have predominantly been targeted at low-income households, while permanent measures such as tax changes have been targeted at higher income households, meaning that income gaps have widened, and households on lower incomes will fall further behind.

Delivery on Programme for Government commitments

Social Justice Ireland warmly welcomed the Programme for Government commitment to run progressive budgets. SILC 2024 figures show that adequate levels of social welfare are essential to the delivery of this commitment. In Budget 2026, Government should commit to benchmarking core social welfare rates to average earnings and make the commensurate increases in social welfare rates that this requires.

These figures show that more people are falling further behind and a widening disparity between those on the lowest incomes and the rest of society. This especially impacts on those on fixed incomes. It is the same vulnerable cohorts that we see again and again in the poverty figures. A clear policy commitment by Government to protect the most vulnerable in Irish society accompanied by action to support low-income households is urgently required if we are to build a genuinely fair society.

Impact of social welfare payments on poverty

Social welfare payments play a crucial role in reducing poverty. Today’s figures show that without the social welfare system 31 per cent of the population would have been living in poverty in 2024. However, social welfare payments more than halved the poverty rate, reducing it to 11.7 per cent.

In relation to people unable to work due to long-standing health problems, the rates of poverty (32.5 per cent) and deprivation (38.5 per cent) for this cohort remain stubbornly high. Government must implement the commitment to a cost of disability payment and improved services and other supports in Budget 2026.

Children

In 2024, nearly one in six children (15.3 per cent) lived in households that were below the poverty line, and 262,700 children lived in households experiencing deprivation. More than half of children living below the poverty line are experiencing enforced deprivation. The large increase in the number of children in consistent poverty shows that current measures to address child poverty are not working. Given the long-term impacts of poverty on children it is imperative that addressing child poverty is a priority for this government. Addressing the core problem of income adequacy is essential to addressing child poverty.

Fundamentally, child poverty cannot be separated from the poverty experienced by the families to which children belong. Child poverty solutions hinge on issues such as adequate adult welfare rates, decent rates of pay and conditions for working parents, and adequate and available public services. Child benefit also remains a key route to tackling child poverty. It is of particular value to those families on the lowest incomes.

In-work poverty

The CSO figures show that in-work poverty is 5.4 per cent. This equates to more than 140,300 people in employment living below the poverty line. Many working families on low earnings struggle to achieve a basic standard of living. Specific interventions are required to tackle the issue of the ‘working-poor’. One of the most effective policy interventions would be to make tax credits refundable. Until Government makes tax credits refundable, it will not have an efficient mechanism by which it can address the issue of the working poor.

The in-work poverty figure has remained consistently above 100,000 for several years now, indicating that in-work poverty is a trend which policy-makers and successive Governments have thus far failed to make any impact on. The idea of a job as an automatic poverty reliever is clearly contradicted by this data. The job must be well paid with decent conditions and adequate hours.

Year after year this large group of workers hears of gains from the Budget but experiences little if any of them; something that cannot persist both due to its distributive effects and the socio-political reality that we cannot keep ignoring these workers and families.

Policy recommendations

If poverty and deprivation rates are to fall in the years ahead, Social Justice Ireland believes that in the period ahead Government, and policymakers generally, should:

- Benchmark core social welfare rates to 27.5 per cent of average weekly earnings in 2025 as a first step towards indexing social welfare rates against wages.

- Acknowledge that Ireland has an on-going poverty and deprivation problem.

- Adopt targets aimed at reducing poverty and deprivation among particularly vulnerable groups such as children, lone parents, jobless households, and those in social housing.

- Examine and support viable alternative policy options aimed at giving priority to protecting vulnerable sectors of society.

- Carry out in-depth social impact assessments prior to implementing proposed policy initiatives that impact on the income and public services on which many low-income households depend. This should include the poverty-proofing of all public policy initiatives.

- Recognise the problem of the ‘working poor’. Make tax credits refundable to address the situation of households in poverty which are headed by a person with a job.

- Support the widespread adoption of the Living Wage so that low paid workers receive an adequate income and can afford a minimum, but decent, standard of living.

- Introduce a cost of disability allowance to address poverty and social exclusion of people with a disability.

- Recognise the reality of poverty among migrants and adopt policies to assist this group. In addressing this issue, replace direct provision with a fairer system that ensures adequate allowances are paid to asylum seekers.

- Accept that persistent poverty should be used as the primary indicator of poverty measurement and assist the CSO in allocating sufficient resources to collect this data.

- Move towards introducing a basic income system. No other approach has the capacity to ensure all members of society have sufficient income to live life with dignity.

- Acknowledge the failure to meet repeated policy targets on poverty reduction and commit sufficient resources to achieve credible new targets.