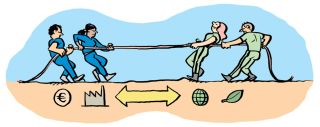

Coherence in public policy is important if we are to achieve our goals as a society

Policy Coherence is defined by the OECD as the systematic promotion of mutually reinforcing policy actions across government departments and agencies creating synergies towards achieving the agreed objectives.

In plain language, it means making sure that the goals of one policy, or set of policies, does not conflict with another. Admittedly this is often more easily aspired to than achieved, but Ireland has a particularly bad record on it. Here are a couple of examples.

Overseas Aid

Budget 2019 allocated €817m in funding to Official Development Aid (ODA), often referred to as Overseas Aid. This money will be used to provide development aid to less developed countries in Africa and Asia, provide relief from humanitarian disasters, and promote human rights in the Global South.

One reason such aid is required from more developed countries like Ireland is that many of Irish Aid’s nine partner countries – eight of whom are in sub-Saharan Africa – do not have a sufficiently robust, developed or stable tax-base from which they themselves can raise the necessary revenue to build the infrastructure and provide the services that would improve the lives of their citizens.

It is presumably hoped that such assistance is not intended to be given in perpetuity and that the goal is to develop the social and economic fabric of these countries to a point where all countries of the Global South will be capable of providing a minimally decent standard of living to all their citizens wihout outside aid. However, such a point can never be reached if the global tax system continues to allow multi-national corporations to shift their profits outside the reach of such developing countries. Oxfam estimates that tax avoidance and evasion rich people and large corporations costs poor countries $170 billion every year. This is a huge amount of money in any country, but particularly so in the poorest countries in the world where such amounts could, if invested properly, have a significant positive effect on the standard of living.

However, instead of being used to funds vital public services like healthcare and education, which are key to reducing inequality and helping people to build better lives for themselves, corporations are availing of tax loopholes to channel this money away from the Global South, preventing poor countries from establishing a stable tax-base of their own. It is the tax systems of developed Western countries that facilitate this behaviour and Ireland is a main offender. Social Justice Ireland calls again on the government to take real action to reduce the prevalence of brass plate companies in Ireland and the ability of multi-nationals corporations to exploit legal and accounting loopholes for the purposes described above, and to play a leadership role in bringing about positive change in the international tax system to stop such practices.

Fossil Fuels

It has been well documented that Ireland is something of a laggard in comparison to our European peers when it comes to climate action and environmental policy. We are already guaranteed to miss our climate targets for next year and are well off course for our 2030 targets too.

The Central Statistics Office (CSO) recently published a report that highlighted some of the ways that Ireland directly and indirectly provides support for fossil fuel extraction and consumption, as well as other actions that are potentially damaging to the environment. The numbers do not make for encouraging reading.

The CSO estimates that in 2016, the total amount in direct subsidies and revenue foregone due to preferential tax treatment supporting fossil fuel activities in Ireland was €2.5 billion, while a further €1.6 billion supported other potentially environmentally damaging activities. That's a total amount for potentially environmentally damaging subsidies of €4.1 billion in one year. Supports to fossil fuel activities increased on a year by year basis from 2012 to 2016 from €2.3 billion in 2012 to €2.5 billion in 2016.

More than half a billion euros (€534 million) was spent on direct supports for fossil fuel use in 2016. The Public Service Obligation levy – commonly known as the PSO, a levy Social Justice Ireland has campaigned for the abolishment of for years – to support peat-powered electricity and welfare programmes like the fuel allowance accounted for approximately 93 per cent of this spend. However, as has recently been pointed out by the Nevin Economic Research Institute (NERI), the larger part of government supports for fossil fuel use – and implicit subsidisation – occurred through exemptions in the tax code. The government levies lower excise on Auto-diesel, Marked Gas Oil, Kerosene, Aviation fuel and fuel oil than it does on unleaded petrol. If the state had levied the same excise on these fuels in 2016, an additional €2 billion extra in tax could have been collected. This is over 3 per cent of the total tax take in 2016. If rates of excise reflected the amount of carbon in these fuels, additional revenue would have been higher.

In relation to our environmental goals, it's also worth noting that agricultural goals such as expanding the national herd are also in direct contradiction to our environmental targets, given how significant a contributor cattle are to emissions.

Irish Government expenditure as it relates to ODA and fossil fuels, and how the Irish tax system functions, represents just two of the many contradictions within Irish public policy. On the one hand, money is being spent (or revenue being foregone) to achieve a certain goal. On the other, behaviour that is completely at odds with those goals is being promoted by the tax system.

GIVING A VOICE TO THOSE

WHO DON’T HAVE A VOICE

When you support Social Justice Ireland, you are tackling the causes of problems.