Time to review fossil fuel subsidies

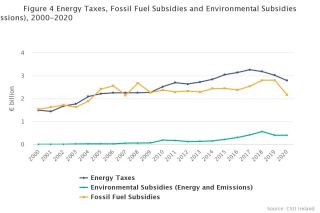

According to the latest data from the Central Statistics Office total fossil fuel subsidies in 2020 were €2.2 billion, compared with €2.8 billion in value in 2019. The decrease was mainly due to the the reduction in consumption of fossil fuels for transport, in particular aviation, due to the COVID-19 pandemic. In 2020, €2.8 billion was raised in energy taxes, €0.4 billion was spent on environmental subsidies related to energy and air emissions, and fossil fuel subsidies were €2.2 billion. Fossil fuel subsidies have increased significantly over the past two decades. In 2000 fossil fuel subsidies were estimated at €1.5 billion in value. This increased to €2.7 billion in 2008. Between 2009 and 2016 the value was estimated as between €2.2 billion and €2.5 billion. Total fossil fuel subsidies increased in value in 2017, 2018 and 2019, reaching €2.8 billion in 2019. In 2020 fossil fuel subsidies were €2.2 billion, with the reduction in transport fossil fuel consumption due to the COVID-19 pandemic accounting for the decrease.

Indirect Fossil Fuel Subsidies - by type

|

Indirect Fossil Fuel Subsidies |

Payment |

|

Fossil Fuel Production |

|

|

Zero Royalties on Gas and Oil Production |

Royalty |

|

Expensing of Exploration and Development Costs |

Corporation Tax |

|

Stamp Duty Relief on Licences and leases granted under Petroleum and Other Mineral Development Act, 1960, etc. |

Stamp Duty |

|

Road Transport Fuels |

|

|

Diesel Rebate Scheme |

Excise |

|

Fuel Excise Repayment for Disabled Drivers and Passengers |

Excise |

|

Revenue Foregone: Autodiesel |

Excise |

|

Revenue Foregone: Auto LPG |

Excise |

|

Revenue Foregone: Scheduled Passenger Road Transport Services |

Excise |

|

Autodiesel VAT Refund |

VAT |

|

Air, Water, Rail Transport Fuels |

|

|

Fuel Excise Repayment for Commercial Sea Navigation |

Excise |

|

Jet Kerosene Excise Exemption |

Excise |

|

Free Allocation of Emissions Allowances to Airline Operators within EU-ETS |

Cost of Allowances |

|

Revenue Foregone: Marked Gas Oil for Rail Transport |

Excise |

|

Partial Excise Repayment on Aviation Gasoline used for Commercial Purposes |

Excise |

|

Marine Diesel Scheme |

VAT |

|

Zero VAT on Jet Kerosene for International Flights |

VAT |

|

NORA Levy Exemptions |

NORA Levy |

|

Fuels used in Industry |

|

|

Fuel Oil Excise Exemption for Manufacture of Alumina |

Excise |

|

Fuel Excise Repayment for Horticulture |

Excise |

|

Revenue Foregone: Marked Gas Oil for Agriculture, Fishing, Industry |

Excise |

|

Natural Gas Carbon Tax Exemption for Certain Industrial Uses |

Carbon Tax |

|

Solid Fuel Carbon Tax Exemption for Certain Industrial Uses |

Carbon Tax |

|

Relief for Increase in Carbon Tax on Farm Diesel |

Carbon Tax |

|

Free Allocation of Emissions Allowances to Companies within EU-ETS |

Cost of Allowances |

|

Revenue Foregone: Fuel Oil |

Excise |

|

Heating Fuels |

|

|

Revenue Foregone: Kerosene |

Excise |

|

Revenue Foregone: Other LPG |

Excise |

|

Zero Excise on Coal |

Excise |

|

Zero Excise on Peat |

Excise |

|

Zero Excise on Natural Gas |

Excise |

|

Solid Fuel Carbon Tax Exemption under Diplomatic Arrangements |

Carbon Tax |

|

Reduced VAT rate on Energy Products |

VAT |

|

Electricity |

|

|

Electricity Excise Exemption for Domestic Use |

Excise |

|

Revenue Foregone: Business Electricity Use |

Excise |

|

Relief from Taxation on Electricity used for Certain Industrial Purposes/Generated in Certain Circumstances |

Excise |

Direct Fossil Fuel Subsidies - by type

|

Direct Fossil Fuel Subsidies |

|

Fossil Fuel Production |

|

Petroleum Exploration and Production Promotion and Support (PEPPS) Programme |

|

Government Fossil Fuel R&D Funding |

|

SFI Funding to Fossil Fuel Research |

|

Fossil Fuel Consumption |

|

PSO Levy: Electricity Generation from Peat |

|

PSO Levy: Security of Electricity Supply |

|

Electricity Allowance |

|

Gas Allowance |

|

Fuel Allowance |

|

Other Supplements (including Heating) |

|

Smokeless Coal Allowance |

|

Fuel Grant for Disabled Drivers and Passengers |

Some of the key findings from Fossil Fuel Subsidies 2020 are:

- Direct fossil fuel subsidies accounted for 13% of total fossil fuel subsidies in 2020 while indirect subsidies arising from revenue foregone due to tax abatements accounted for 87%.

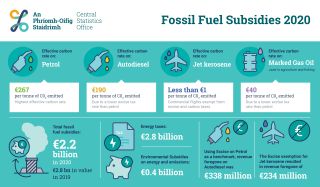

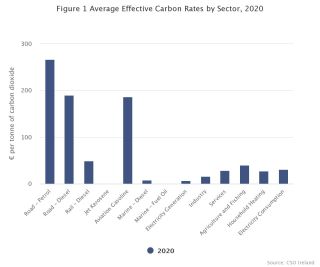

- In 2020, consumers of petrol paid an average effective rate of €267 per tonne of carbon dioxide emitted.

- The average effective carbon rate on autodiesel was €190 per tonne of carbon dioxide in 2020.

- Carbon dioxide emissions from jet kerosene were charged at €0.09 per tonne due to the tax exemption for commercial aviation.

- In 2020, total energy taxes on petrol were 63 cent per litre while total energy taxes on autodiesel were 51 cent per litre.

- Fossil fuel subsidies were estimated at €2.2 billion in 2020 compared with €2.8 billion in value in 2019. The decrease was mainly due to the reduction in the use of international aviation fuel during the COVID-19 pandemic.

- Direct fossil fuel subsidies accounted for 13% of total fossil fuel subsidies in 2020 while indirect subsidies arising from revenue foregone due to tax abatements accounted for 87%.

- In 2020, €2.8 billion was raised in energy taxes, €0.4 billion was spent on environmental subsidies related to energy and emissions, and fossil fuel subsidies were €2.2 billion.

- Jet kerosene used for commercial aviation is exempt from excise and carbon taxes. Using the excise duty for heavy oil used for air navigation as a benchmark, the CSO estimates that the amount of revenue foregone in 2020 on jet kerosene due to the tax exemption was €234 million. This compares with €634 million in 2019, before the pandemic.

- Using the petrol excise duty rate as a benchmark, the CSO estimates the amount of revenue foregone on autodiesel in 2020 due to a lower excise duty rate as €338 million, compared with €400 million in 2019.

- The CSO found that the highest average effective carbon rate per tonne of carbon dioxide in 2020 was €267 for petrol. The average effective carbon rate for autodiesel was 29% lower at €190 per tonne of carbon dioxide due to the lower excise duty rate applied to this fuel. The average effective carbon rate for marked gas oil, sometimes referred to as ‘green diesel’, used in agriculture, forestry and fishing was €40 per tonne of carbon dioxide.

Charts 1 shows the average carbon tax rates by sector in 2020 and Chart 2 tracks fossil fuel subsidies, energy taxes and environmental subsidies over a twenty year period.

A taxation system that supports our environmental goals

Our national economic, social and environmental priorities should be aligned. Our taxation policies should support us meeting our environmental targets. Environmental subsidies are an element of the environmental tax code that should be reviewed. These subsidies mean that government has a wider fiscal space available to it in terms of climate policy and taxation. Government can address climate challenges by removing those subsidies which are harmful rather than levying new environmental taxes or increasing the existing environmental tax rates/levels. This gives additional budgetary space for Government when implementing and designing climate policy.

Between 2012 and 2016, €4 billion per annum in taxation was forgone through potentially environmentally damaging subsidies. €2.5 billion went in direct subsidies and preferential tax treatment supporting fossil fuel activities in Ireland and a further €1.6 billion supported other potentially environmentally damaging activities in the Agriculture, Transport and Fisheries sectors. A study by the ESRI found that budgetary cost of these subsidies was over six times higher than the entire carbon tax revenue of the Government in 2017.

The value of environmental subsidies is substantial. By ending environmentally damaging tax breaks and investing this money in people, communities and regions that will be most affected by climate adaptation, Government can help to ensure a Just Transition. It also increases the fiscal space available to government in terms of climate policy. Government can alleviate adverse climate change impacts by removing these subsidies rather than levying new environmental taxes or increasing the existing environmental tax rates/levels. This is something that must be considered in budgetary terms when implementing and designing climate policy.

The latest CSO release highlights the disparity between Jet Kerosene foe aviation and other fuels such as petrol and diesel. The effective carbon rate on petrol in 2020 was €267 per tonne, the effective carbon rate on diesel was €190 per tonne. The effective carbon rate on Jet Kerosene in 2020 was less than €1 per tonne. The CSO estimates that the amount of revenue foregone in 2020 on jet kerosene due to the tax exemption was €234 million, compared with €634 million in 2019, before the pandemic. As economic activity continues to increase in 2022 this figure will begin to increase again. As we begin to look at what measures are required to deliver on the policies in the Climate Action Plan, we must look at the aviation sector and the policy levers that are available to ensure that it makes a contribution to our climate targets. Social Justice Ireland has consistently argued that the aviation sector should make a contribution to Ireland’s emissions targets[1] and outlined proposals as to how this could be achieved. Now that Government has published ‘The Impacts of Aviation Taxation in Ireland’ it is important that the key recommendations of this report, to target the taxation of CO2 directly by abolishing the Jet Kerosene exemption.

In terms of overall public expenditure, systematic reviews should be carried out and published on the sustainability impacts and implications of all public subsidies and other relevant public expenditure and tax differentials. Subsidies which encourage activity that is damaging to natural, environmental and social resources should be abolished.

Eliminating harmful subsidies and investing in renewable energy and schemes to address energy poverty would put Ireland in a much better place to meet our energy targets. If Government is really serious about Ireland transitioning to a low carbon economy all subsidies for fossil fuels should be reviewed in 2022, with those which are harmful removed and the savings invested in renewable energy.

[1] For further details see our proposal on aviation taxation in Budget Choices 2020, 2021 and 2022.