Temporary Budget measures concentrated in low income households

Temporary measures contained in Budget 2024 are more concentrated among welfare dependent households and those at work but on low incomes. However, temporary payments will not carry over to future years income and the relative standing of these households is likely to deteriorate in the near term. ‘Tracking Distributive Effects of Budget Policy – 2024 edition’ considers the distributive impact of the Budget taking account of the differences between temporary and permanent measures, and the long-term impacts these measures will have on household incomes.

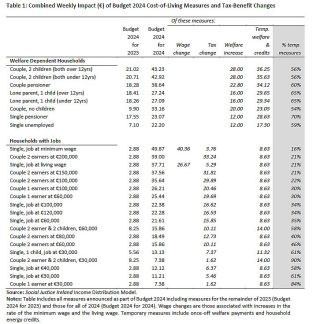

Distributive Analysis of Budget 2024’s Cost-of-Living and Tax-Benefit Measures

‘Tracking Distributive Effects of Budget Policy – 2024 edition’ provides assessments of recent distributive choices:

- a distributive analysis of all the measures announced in Budget 2024 and an assessment of the proportion of these that represent temporary income changes;

- an assessment of the overall scale of Government support via various cost of living and energy crisis measures between April 2022 and April 2024;

- a distributive analysis of the four Budgets delivered to date by the current Government (Budget 2021 in October 2020, Budget 2022 in October 2021, Budget 2023 in September 2022, and Budget 2024 in October 2023);

- an assessment of how the gaps between jobseekers and those on middle and very high incomes have changed over recent years including the impact of the measures in the most recent Budget and cost of living initiatives.

Looking at household income changes as a result of Budget 2024, this analysis finds that temporary measures are more concentrated among welfare dependent households and those at work but on low incomes. On the other hand, the income gains received by higher income working households are much more associated with permanent measures such as income taxation reductions.

Cost of living measures 2022 - 2024

Since early 2022, Government have announced a series of taxation, welfare and temporary welfare and electricity credit measures intended to assist all households with cost of living pressures; with the first of these payments being made in April 2022. Looking at the impact of these changes up to April 2024 we can see that while the overall picture reflects an outcome where the most assistance has been given to welfare dependent households, something we called for and have welcomed, the underlying picture remains a concern. Since April 2022, much of the income support received by lower income households has been in the form of temporary measures while most of the support received by higher income households has been delivered via permanent measures.

Social Justice Ireland has consistently argued for the prioritisation of low-income welfare dependent families in Budgetary policy and welcomes how recent cost of living supports have particularly assisted this group. However, we are concerned that the permanent changes to income taxation levels in recent Budgets have shifted away from this approach and regrettably expect that much recent progress will be reversed.

‘Tracking the Distributional Effects of Budget Policy – 2024 edition’ is available to download here.