Future Forty - a fiscal and economic outlook to 2065

'Future Forty - A Fiscal and Economic Outlook to 2065' has been published by the Department of Finance and it examines the long-term impacts of global megatrends and other structural shifts and their potential impact on Ireland’s economy and public finances in the years ahead. The analysis presents a Central Scenario, as well as multiple alternative possible future outcomes. In total, over 2,000 scenarios have been modelled, which collectively point to continued growth in living standards, but with slowing growth over the long-term, and a steady decline of our fiscal position.

Future Forty sets out projections across more than 2,000 scenarios, covering tax revenue, public spending, deficits and national debt. These projections are intended to guide long-term policy choices. Maintaining a sustainable economy over the coming decades will require coherent policies which address challenges, embrace opportunities, while also building resilience for unanticipated shocks. Future Forty provides a long-run economic and fiscal outlook, or a ‘Central Scenario’ for the Irish economy over the next four decades from the most appropriate current data. Future Forty projects the key drivers of economic growth, population, labour, capital investment, and productivity and outlines the importance of each across various scenarios. The key instrument in the policy toolkit of the State is its fiscal resources, which are also projected. It allows challenges across policy areas to be compared in terms of their fiscal and economic impacts; providing a more complete understanding of when they will materialise over the next four decades. It also provides projections population, labour supply, investment and productivity.

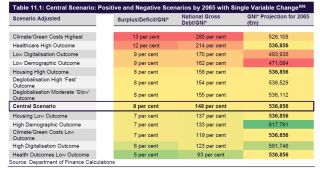

The analysis presents a Central Scenario, as well as multiple alternative possible future outcomes. In total, over 2,000 scenarios have been modelled, which collectively point to continued growth in living standards, but with slowing growth over the long-term, and a steady decline of our fiscal position. This is due mainly to demographic shifts, slowing productivity, climate costs and a slowdown in corporation tax receipts.

The Central Scenario, which reflects the core assumptions across all trends, points to an average annual growth rate in all expenditure greater than 2 per cent. In the same Scenario, exchequer revenue, by contrast, declines over forty years, primarily due to a fall-off in corporation tax receipts, which are projected to decline from 8 per cent of GNI* in 2025 to 4.5 per cent of GNI* by 2040. Total exchequer revenue is projected in this Scenario to fall from 34.5 per cent of GNI* in 2025 to 31.6 per cent by 2065. This generates increasing annual fiscal deficits, which, in the reach 7.9 per cent of GNI* by 2065 driving overall National Debt to 148 per cent of GNI*.

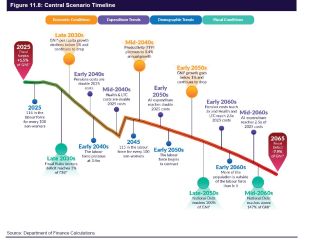

The Central Scenario highlights three distinct periods. On a ‘no policy change’ basis:

- Between 2025 and 2037, the annual deficit remains below 3 per cent of GNI*, economic growth remains above 1 per cent and Gross National Debt remains less than 50 per cent of GNI*.

- Between 2038 and 2054, public finances deteriorate as the annual deficit moves towards 5 per cent of GNI*. Economic growth declines to less than 1 per cent and Gross National Debt reaches 100 per cent of GNI*.

- Between 2055 and 2065, without fiscal remedies or a change in the underlying economic circumstances, the deficit continues to grow towards -8 per cent of GNI*, economic growth falls towards 0.6 per cent, and National Debt reaches 148 per cent of GNI*.

By the mid-to-late 2030s, demographic shifts will constrain economic growth and increase fiscal pressures, hindering the State’s ability to respond to crises. Therefore, the next ten years will be crucial for implementing reforms before fiscal flexibility diminishes. Key priorities in this window should include:

Enhancing long-run productivity growth, particularly for domestic sectors, by ensuring all future expenditure decisions assess long-run productivity impacts as part of the expenditure prioritisation process.

- Encouraging continued and efficient capital investment, both public and private, to address infrastructure deficits and increase the supply of housing.

- Improving cost-efficiencies in the healthcare and aged care systems, before the impacts of population ageing increase pressure on these services.

- Accelerating the green transition and upgrading national infrastructure to deal with the worst potential impacts of climate change.

- Continue to enhance the management of migration, to prioritise the attraction and retention of skilled migrants.

- In the context of increased global protectionism, Ireland must preserve its close ties with major trade and investment partners, while bolstering domestic industries to ensure the long-term viability of its economic model.

- Taking a proactive and planned approach to digitalisation to facilitate its adoption to enhance productivity, while investing in skills, particularly for those with lower education levels, to minimise potential negative impacts from digitalisation.

Implementing proactive policy measures now, which focus on prioritising spending decisions to achieve long-term goals, will significantly improve Ireland’s long-term economic outlook and, thereby, prevent an unsustainable debt burden on future generations. Although stark, these projections are consistent with the long-term trajectory across many advanced economies. Comparisons with international peers, using OECD Debt-to-GDP forecasts, show that under the Central Scenario, Ireland’s projected debt levels remain lower than those of New Zealand, the United Kingdom, France, Finland, the United States and Germany. By the late 2030s, economic challenges will begin to cause constraints, increasing pressure on public finances, hindering the State’s ability to respond to crises. This highlights this next decade as a window of critical opportunity to boost economic growth potential and address structural challenges.

Social Justice Ireland welcomes the publication of Future Forty and the projections contained across the various areas. This is the type of data and analysis required to inform Government policy to build a better Ireland, planning for a future where public policy is underpinned by the Common Good and a social contract which values everyone's contribution. This analysis should inform policymaking, social dialogue and the work of Government as we plan now to meet the challenges and make the most of the opportunities that will arise over the next forty years. This work must start with a discussion on how we can build strong and sustainable public finances now, and plan for our revenue and expenditure needs into the future.