Corporation Taxes in Ireland

While much discussion in recent years has centred on once-off windfall corporate tax revenues and how these revenues should be used, it is important that Government look at the role that recurrent corporate tax revenues plan in the Irish economy as it prepares to implement a forthcoming minimum effective rate of corporation tax as part for global corporate taxation reforms. In 2024 Government will introduce relevant measures to levy a minimum effective rate of corporation tax of 15 per cent for large firms with a global annual turnover of over €750m in at least two of the last four years.

Corporation Taxes in Ireland

Over the past few years, there has been a growing international focus on the way multi-national corporations (MNCs) manage their tax affairs. The OECD’s Base Erosion and Profits Shifting (BEPS) examination has established the manner and methods by which MNCs exploit international tax structures to minimise the tax they pay.[1] Similarly, the European Commission has undertaken a series of investigations into the tax management and tax minimisation practices of a number of large MNCs operating within the EU, including Ireland. The European Parliament’s Special Committee on Tax Rulings has also completed a review of the EU tax system and highlighted its problems and failures (TAXE, 2015).[2]

Given the timeliness and comprehensiveness of this work, it is important that it leads to the emergence of a transparent international corporate finance and corporate taxation system where multinational firms pay a reasonable and credible effective corporate tax rate. We welcome progress towards this over the past year, and the acceptance by the Irish Government that the system needs to change albeit that this will result in lower corporate tax revenues to the exchequer in the years to come. The current windfall corporate taxation revenues, estimated to be between €11bn-€12bn per annum by the Fiscal Advisory Council, clearly highlights the unsustainable nature of the current system[3].

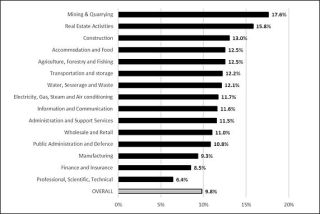

A chapter within the 2016 Report of the Comptroller and Auditor General[4] provided a new and important insight into corporation tax receipts in Ireland. The report is the first comprehensive examination of this area for some time, even though corporation taxes comprised around 15 per cent of annual tax revenue at that time (it now accounts for almost one quarter). Looking at tax receipts for 2016, it found that there were 44,000 corporate taxpayers but that receipts were dominated by “a small number of taxpayers, mainly multi-national enterprises (MNEs)”. The effective rate varied between sectors and the C&AG findings are summarised in chart 4.1; the overall effective corporation tax rate was found to be 9.8 per cent in 2016. The C&AG findings for the effective rate among the top 100 corporate taxpayers, who then accounted for 70 per cent of tax revenue, are summarised in Table 1.

Overall, the C&AG report points towards a concentration of corporation tax among a small group of multi-national firms and highlights that it is a small number of these firms who are aggressively minimising their tax liabilities. A recent report from the Parliamentary Budget Office (PBO) also supports this finding and identified that in 2022, 60 per cent of all corporation tax came from the top 10 corporate taxpayers, with over 40 per cent coming from the top three contributors[5].

Chart 1: Effective Corporation Tax Rates by Sector in Ireland, 2016

Source: C&AG (2017: 296).

Note: Effective tax rates can exceed the statutory rate of 12.5% where there is income beyond trading profits such as passive income which is charged at 25%.

|

Table 1: |

Effective Corporate Tax Rates of the Top 100 Taxpayers, 2016 |

|

Effective Rate |

Number of Companies |

|

0% or less |

8 |

|

Between 0% and 1% |

5 |

|

Between 1% and 5% |

1 |

|

Between 5% and 10% |

7 |

|

Between 10% and 12% |

14 |

|

More than 12% |

65 |

|

Total |

100 |

Source: C&AG (2017: 299

Social Justice Ireland has long advocated for the adoption of an EU-wide agreement on a minimum effective rate of corporation tax. We welcome international developments over the past few years to achieve a minimum effective rate of 15 per cent for large firms, but this is still low and open to being undermined by use of tax breaks and tax write-offs, such that some large firms will continue to contribute small amounts of corporate taxation. We also welcome Ireland’s adoption of this rate from 2024 which will apply to all firms with a global annual turnover of over €750m in at least two of the last four years. While the aforementioned 15 per cent minimum effective rate applies to large firms, Social Justice Ireland believes that a minimum effective rate of corporate tax should apply to all firms to ensure everybody pays their fair share. In the medium-term, we believe that a minimum rate should be agreed within the EU and set below the 2021 EU-27 average headline rate of 21 per cent but above the existing low Irish level.[6] A headline rate of 17.5 per cent and a minimum effective rate of 10 per cent seem appropriate. This reform would simultaneously maintain Ireland’s low corporate tax position and provide additional revenues to the exchequer. Based on the C&AG report, the impact of such a reform would be confined to a small number of firms yet it is likely to sustainably raise overall corporate tax revenues. Rather than introducing this change overnight, agreement may need to be reached at EU level to phase it in over three to five years. Reflecting this, we proposed prior to Budget 2024 that the effective rate be adjusted to a minimum of 6 per cent – an opportunity regrettably missed.

Social Justice Ireland believes that the issue of corporate tax contributions is principally one of fairness. Profitable firms with substantial income should make a contribution to society rather than pursue various schemes and methods to avoid these contributions.

[1] See www.oecd.org/ctp/beps.htm

[2] See www.europarl.europa.eu/committees/en/taxe/home.html

[3] https://www.fiscalcouncil.ie/fiscal-assessment-report-june-2023-2/

[4] http://opac.oireachtas.ie/AWData/Library3/CAGdocslaid290917b_104259.pdf

[5] https://data.oireachtas.ie/ie/oireachtas/parliamentaryBudgetOffice/2024/2024-03-25_an-analysis-of-corporation-tax-revenue-growth_en.pdf

[6] https://op.europa.eu/en/publication-detail/-/publication/f85da28f-f5be-…